The benefits of Internet Banking

Manage your credit card and/or Everyday Savings Account online

Update your contact details, request a change to your credit limit (M&S Credit Card customers only), pay bills and send money

View the balances of your other M&S Bank products such as your M&S Cash ISA or M&S Personal Loan

What you’re going to need to register

To register for Internet Banking, you’ll need:

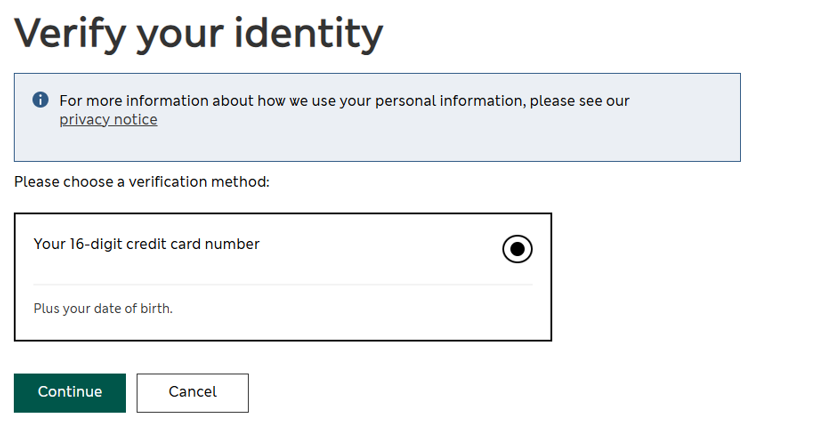

- Your M&S Credit Card details

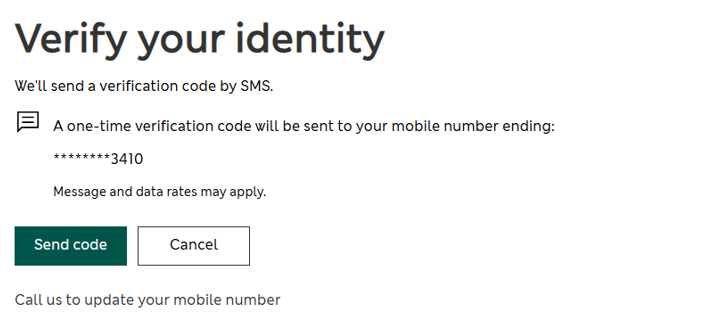

- A valid mobile phone number registered with us. Need to update your details?

- Your mobile phone

If you have an Everyday Savings Account, you will need to register for Digital Banking using our app.

Ready to get started?

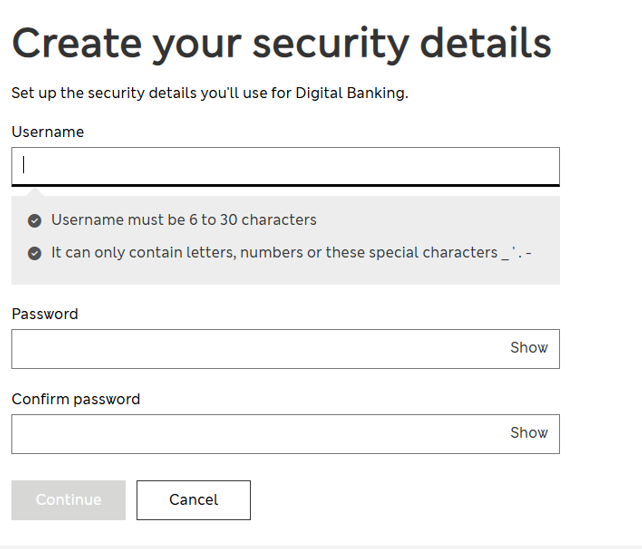

Follow the step by step instructions below to help you get registered for Internet Banking

Already registered?

If you’re already registered for Digital Banking, you can just sign in.

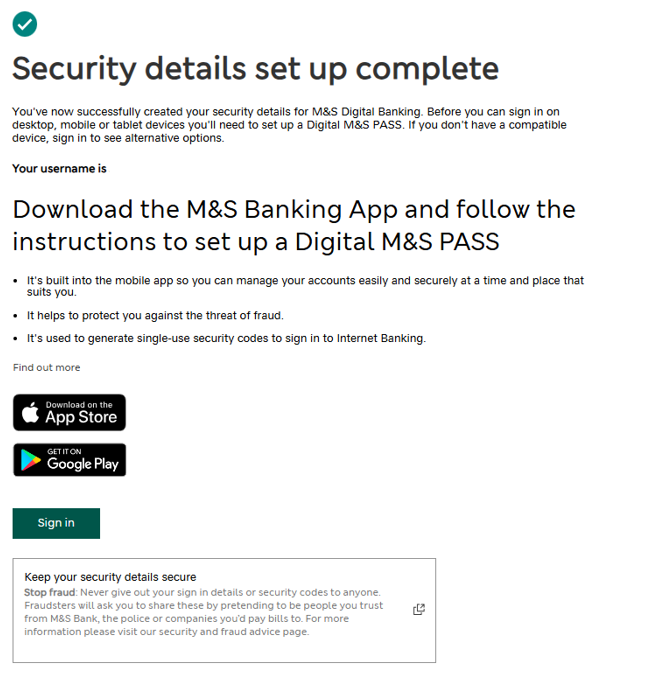

Digital M&S PASS

You can access the Digital M&S PASS by downloading the M&S Banking App.

- Our app gives you quick and easy access to mobile and Internet Banking

- You can securely sign in with your face or fingerprint on compatible devices

- Gain access to your accounts now - no need to wait for a physical M&S PASS to arrive

If you're ready to set up your Digital M&S PASS, head to the App store or Google Play store to download the M&S Banking App. Please note device restrictions apply.

More features of the M&S Banking App

- View your credit card PIN in an instant

- Confirm your online payments

- Receive spend notifications when you spend on your M&S Credit Card

- Download mobile credit card statements

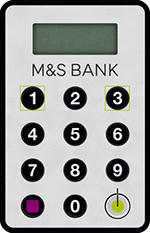

Physical M&S PASS

If you don't have a compatible device, you can order a physical M&S PASS which will generate the security codes you’ll need to access your accounts.

To order a physical M&S PASS, sign in to Internet Banking using the details you’ve set up and select the option to ‘Order M&S PASS’.

Looking for digital skills support?

AbilityNet in partnership with BT Group are running digital skills sessions in various locations across the UK. They are providing free workshops to people aged 65 or over, in either communal spaces or at your home to help you improve your digital skills.

Need extra help or support?

We understand that everyone has different needs. Whether you are dealing with a life event, would like information sent to you in a certain format, or you have health and accessibility needs, we’re here to help.